Home

NDAA

Ned Davis Research 360° Dynamic Allocation ETF

Fund Overview

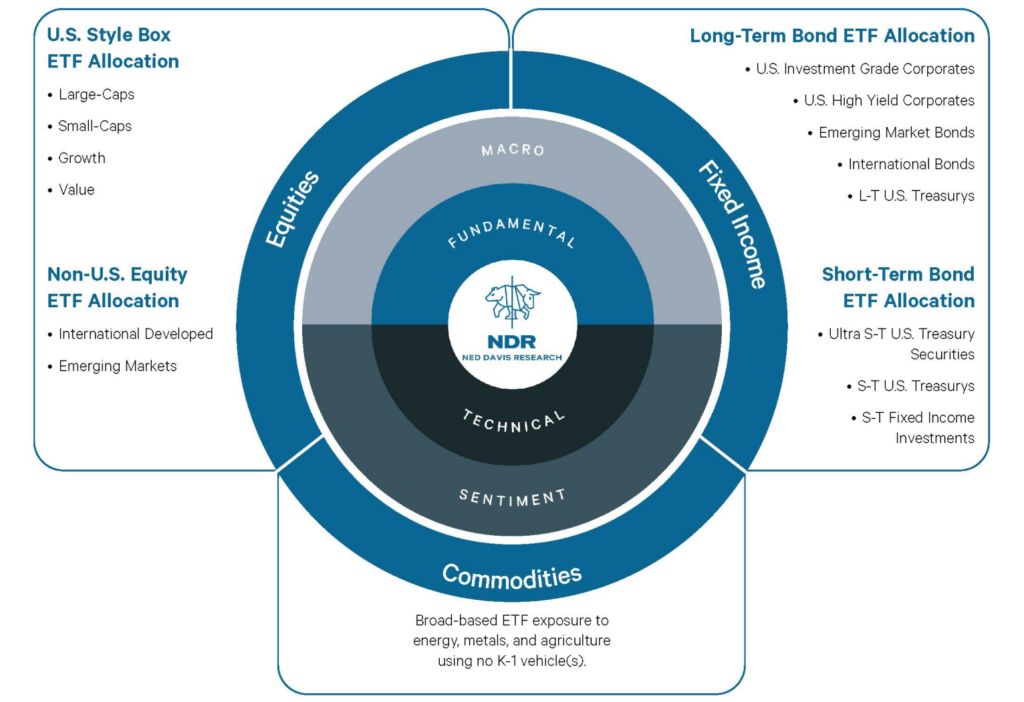

The Fund is an actively managed exchange-traded fund (“ETF”) that primarily invests in passively managed ETFs (“Underlying ETFs”), including affiliated ETFs that use the Ned Davis Research’s models or indices, that, in turn, principally invest in equity securities, long- and short-term bonds, and commodities.

The Fund’s sub-adviser, Ned Davis Research (“NDR,” or the “Sub-Adviser”), constructs the Fund’s portfolio using its “360° Approach,” which is a comprehensive and multifaceted investment methodology. NDR’s 360° Approach integrates a wide range of data and analytical perspectives to seek to provide a holistic view of the markets (global equity, bond, commodity, and money market).

The Fund’s portfolio will generally hold approximately between 5 and 20 Underlying ETFs. The Fund may also hold cash or cash equivalents. The Sub-Adviser reviews the Fund’s portfolio for potential reallocation on at least a monthly basis.

Fund Summary

NDR uses its 360° Approach to allocate the Fund’s portfolio across a mix of equity, long- and short-term bonds, and commodity ETFs.

NDR makes investment decisions based on the weight-of-the-evidence from indicators selected by NDR’s research team. NDR’s 360° Approach comprises the following four traditional investment pillars: macroeconomic, fundamental, technical, and sentiment.

The Fund’s portfolio managers make allocation decisions between equities and fixed income using its 360° Approach, which considers both macroeconomic and technical pillars. Within each asset class, NDR bases allocations on indicators such as trend-following, rate-of-change, and overbought/oversold conditions. NDR’s model selects investment products with favorable technical readings for implementation. Additionally, the Fund may invest, to a limited extent, in commodity ETFs. NDR evaluates commodity ETFs based on technical, macroeconomic, and sentiment indicators.

The strategy uses a target allocation of 60% global equities and 40% global bonds. However, NDR’s model may dictate allocations that deviate significantly from the target depending on market conditions. It is possible that the Fund may allocate up to 100% of its assets in equities, or 100% in bonds.

Portfolio Managers

Amy Lubas, CFA

Lisa Michalski, CFA

Brian Sanborn, CFA

Fund Details

| Fund Inception | 10/16/2024 |

|---|---|

| Primary Exchange | NASDAQ |

| Gross Expense Ratio | 0.80% |

| Net Expense Ratio** | 0.65% |

| CUSIP | 886364256 |

| Fee Waiver | 0.15% |

| Fund Name | Ned Davis Research 360 Dynamic Allocation ETF |

| 30 Day SEC Yield* As of 06/30/2025 | 2.25% |

As of 07/31/2025

**The 30-Day Yield represents net investment income earned by the Fund over the 30-Day period ended 07/31/2025, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-Day period. The 30-Day unsubsidized SEC Yield does not reflect any fee waivers/reimbursements/limits in effect.

*The Net Expense Ratio includes management fees and Acquired Fund Fees and Expenses. The Adviser has agreed to reduce its unitary management fee to 0.50% of the Fund’s average daily net assets through at least January 31, 2026. The Total Annual Fund Operating Expenses After Fee Waiver would be 0.65%.

Fund Data & Pricing

| Name | Value |

|---|---|

| Net Assets | $2.60m |

| NAV | $20.03 |

| Shares Outstanding | 130,000 |

| Premium/discount Percentage | 0.03% |

| Closing Price | $20.04 |

| Median 30 Day Spread | 0.40% |

As of 08/29/2025

***Median 30-Day Spread is a calculation of Fund’s median bid-ask spread, expressed as a percentage rounded to the nearest hundredth, computed by: identifying the Fund’s national best bid and national best offer as of the end of each 10-second interval during each trading day of the last 30 calendar days; dividing the difference between each such bid and offer by the midpoint of the national best bid and national best offer; and identifying the median of those values.

Fund Performance

| Name |

|---|

| 07/31/2025 |

| Fund Name | FUND TICKER | 1MO | 3MO | 6MO | YTD | 1YR | 3YR | 5 Year | 10 Year | Since Inception (Cumulative) | Since Inception (Annualized) | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ned Davis Research 360 Dynamic Allocation ETF | NDAA MKT | 0.59 | 8.03 | 2.4 | 4.39 | - | - | - | - | 3.10 | - | 07/31/2025 |

| Ned Davis Research 360 Dynamic Allocation ETF | NDAA NAV | 0.64 | 8.26 | 2.61 | 4.45 | - | - | - | - | 3.05 | - | 07/31/2025 |

| Name |

|---|

| 06/30/2025 |

| Fund Name | FUND TICKER | 1MO | 3MO | 6MO | YTD | 1YR | 3YR | 5 Year | 10 Year | Since Inception (Cumulative) | Since Inception (Annualized) | Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ned Davis Research 360 Dynamic Allocation ETF | NDAA MKT | 3.94 | 4.58 | 3.78 | 3.78 | - | - | - | - | 2.49 | - | 06/30/2025 |

| Ned Davis Research 360 Dynamic Allocation ETF | NDAA NAV | 3.99 | 4.69 | 3.78 | 3.78 | - | - | - | - | 2.39 | - | 06/30/2025 |

The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted above.

Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on historical returns. Returns beyond 1 year are annualized.

A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the fund was traded.

Distribution Detail

| Date | Account | StockTicker | CUSIP | NAME | SHARES | PRICE | MARKET VALUE | WEIGHTINGS | NetAssets | SharesOutstanding | CreationUnits |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 08/29/2025 | NDAA | BCI | 003261104 | abrdn Bloomberg All Commodity Strategy K-1 Free ETF | 6,272.00 | 20.86 | 130,833.92 | 6.90 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | EMB | 464288281 | iShares J.P. Morgan USD Emerging Markets Bond ETF | 1,050.00 | 94.26 | 98,973.00 | 5.22 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | IJR | 464287804 | iShares Core S&P Small-Cap ETF | 819.00 | 118.53 | 97,076.07 | 5.12 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | USHY | 46435U853 | iShares Broad USD High Yield Corporate Bond ETF | 2,574.00 | 37.67 | 96,962.58 | 5.11 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | VUG | 922908736 | Vanguard Growth ETF | 825.00 | 463.98 | 382,783.50 | 20.19 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | IEMG | 46434G103 | iShares Core MSCI Emerging Markets ETF | 6,039.00 | 62.38 | 376,712.82 | 19.87 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | IEFA | 46432F842 | iShares Core MSCI EAFE ETF | 4,279.00 | 86.04 | 368,165.16 | 19.42 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | VOO | 922908363 | Vanguard S&P 500 ETF | 540.00 | 596.52 | 322,120.80 | 16.99 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | FGXXX | 31846V336 | First American Government Obligations Fund 12/01/2031 | 23,340.00 | 100.00 | 23,340.30 | 1.23 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | Cash&Other | Cash&Other | Cash & Other | -891.00 | 1.00 | -890.99 | -0.05 | 1896147 | 90000 | 9 |

Fund Holdings

| Date | Account | StockTicker | CUSIP | NAME | SHARES | PRICE | MARKET VALUE | WEIGHTINGS | NetAssets | SharesOutstanding | CreationUnits |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 08/29/2025 | NDAA | BCI | 003261104 | abrdn Bloomberg All Commodity Strategy K-1 Free ETF | 6,272.00 | 20.86 | 130,833.92 | 6.90 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | EMB | 464288281 | iShares J.P. Morgan USD Emerging Markets Bond ETF | 1,050.00 | 94.26 | 98,973.00 | 5.22 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | IJR | 464287804 | iShares Core S&P Small-Cap ETF | 819.00 | 118.53 | 97,076.07 | 5.12 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | USHY | 46435U853 | iShares Broad USD High Yield Corporate Bond ETF | 2,574.00 | 37.67 | 96,962.58 | 5.11 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | VUG | 922908736 | Vanguard Growth ETF | 825.00 | 463.98 | 382,783.50 | 20.19 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | IEMG | 46434G103 | iShares Core MSCI Emerging Markets ETF | 6,039.00 | 62.38 | 376,712.82 | 19.87 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | IEFA | 46432F842 | iShares Core MSCI EAFE ETF | 4,279.00 | 86.04 | 368,165.16 | 19.42 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | VOO | 922908363 | Vanguard S&P 500 ETF | 540.00 | 596.52 | 322,120.80 | 16.99 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | FGXXX | 31846V336 | First American Government Obligations Fund 12/01/2031 | 23,340.00 | 100.00 | 23,340.30 | 1.23 | 1896147 | 90000 | 9 |

| 08/29/2025 | NDAA | Cash&Other | Cash&Other | Cash & Other | -891.00 | 1.00 | -890.99 | -0.05 | 1896147 | 90000 | 9 |

As of 08/29/2025

Holdings are subject to change without notice.

How to Buy

The Ned Davis Research 360° Dynamic Allocation ETF (NDAA) is available through various channels including via phone (844) 954-5050, broker-dealers, investment advisers, and other financial services firms, including:

This Fund is not affiliated with these financial service firms. Their listing should not be viewed as a recommendation or endorsement.